Indirect Taxation: The Comprehensive Guide

Indirect taxation is very significant in modern systems of taxation and affects the positions of consumers and business entities, as well as governments themselves. Unlike direct taxes, which are levied on income or profits, indirect taxes are levied on goods and services and are usually passed on to consumers. In this article, we will discuss the nature of indirect taxes, their types, their relative advantages and disadvantages, and their role in economic policy. Further, we will have a close look at the specifics of indirect taxation in Ireland.

What is indirect tax?

Indirect tax refers to the tax that is levied not directly on income or profits but on the sale of goods and services. It's collected from the end consumer through an intermediary, usually a retailer, who then pays it to the government. The main characteristic of an indirect tax is that the burden of the tax can be transferred from the seller to the buyer.

Key Features of Indirect Tax

- Hidden Cost: Indirect taxes are usually embedded in commodity price lists and, hence are not as explicit as direct taxes.

- Consumption-based: As against the principle of income, the liability of indirect tax is decided based on the consumption habits of a person.

- Regressive Nature: Indirect taxes are normally regressive, in that the burden resulting from such taxes falls harder on the lower-income groups, who spend a larger part of their income on consumption.

Types of Indirect Tax

Indirect tax can be differentiated into various classes, with each serving a different purpose and function.

- Value Added Tax (VAT): This is basically an indirect tax that is imposed on the value added in any stage of production and distribution. The business concerns collect VAT from consumers and deposit the amount with the government. Thus, it happens to give a tax-on-tax effect. The VAT system has been adopted by many countries around the world. Rates and regulations may vary very significantly.

- Sales Tax: This is the levy imposed on goods and services at the point of sale. It usually consists of a given percentage of the sale price, which retailers collect. Unlike VAT, sales tax is only levied on the final sale to a consumer; it is, therefore, less complex but may not be quite as efficient.

- Excise Duty: A certain indirect tax levied on particular goods, such as alcohol, tobacco, and fuel. These are normally imposed to discourage the consumption of dangerous commodities or to accumulate funds for some specific governmental initiative. The imposition of excise duties can be either on the basis of quantity, known as a specific duty, or on the basis of value, called ad valorem duty.

- Customs Duties: Customs duty refers to taxes payable on commodities imported into a country. Customs duties protect the local industries from foreign competition and provide revenue to the government. Customs duties depend on the nature of goods, source, and value.

- Service Tax: Service tax is levied on the provision of chosen services and not on the sale of goods. The service tax is normally to be first borne by the service provider before passing it on to the consumer through increased prices. Services falling under this may include such sectors as telecommunications, hospitality, and finance.

Advantages of Indirect Tax

- Revenue Generation: Indirect taxes represent a major source of revenue for governments, which provide funds for public services and infrastructures. In addition, they are very easy to collect compared with direct taxes because they come along with the prices of goods and services. Therefore, they are factored into them.

- Wide Tax Base: Since indirect taxes involve a broad base of commodities and services, more of the economy can be captured through them than would be possible with direct taxes. This makes a larger share of the population contribute towards the revenue of the government.

- Encouraging Compliance: Since indirect taxes are collected at the point of sale, compliance tends to be higher. Businesses are also very apt to collect and remit due to certain penalties; hence, there is more efficient tax collection.

Disadvantages of Indirect Tax

- Regressive Nature: Indirect taxes are often cited as regressive in nature because they hurt the lower-income classes the most due to the fact that these groups have an obligation to spend a higher portion of their income on consumption, which in turn means that they actually pay a higher share of their income in indirect taxes.

- Complexity and Administration: Some of the most important issues in the implementation and administration of indirect taxes, such as VAT, revolve around complexities in various regulations, compliance, and reporting requirements overstressing businesses at times, especially small enterprises.

- Price Inflation: The imposition of indirect taxes can lead to inflation in consumer prices. Passing on increased costs by businesses to the consumer may raise the general cost of living and lower purchasing power.

The Role of Indirect Tax in Economic Policy

Indirect taxes have formed and continue to play a significant role in the economic policies and fiscal strategies of many countries. They have impacted consumer behavior and revenue generation for the government, besides acting as tools for economic regulation.

- Consumer Behavior: The government can use the rates of indirect taxes to shape the pattern of consumption. For example, heavy taxes levied on tobacco or alcohol would reduce the number of consumers of these products and thus support public health objectives.

- Economic Stability: Indirect taxes are stable sources of revenue for governments to plan financing of essential services like education, health facilities, and infrastructure on a regular basis. Such stability is highly important in planning long-term economic development.

- Promoting Equity: Although indirect taxes are said to be regressive, many governments use measures that soften their burden on low-income earners. Perhaps this is the exemption of commodities of basic need or lower rates on some of the basic commodities with an objective of fair taxation.

Indirect Tax in Ireland

Ireland adopts a properly organized indirect taxation system that includes several types of taxes, such as VAT, excise duties, and customs duties. VAT is regarded as the key indirect tax in Ireland and forms the lion's share in the contribution to state revenue.

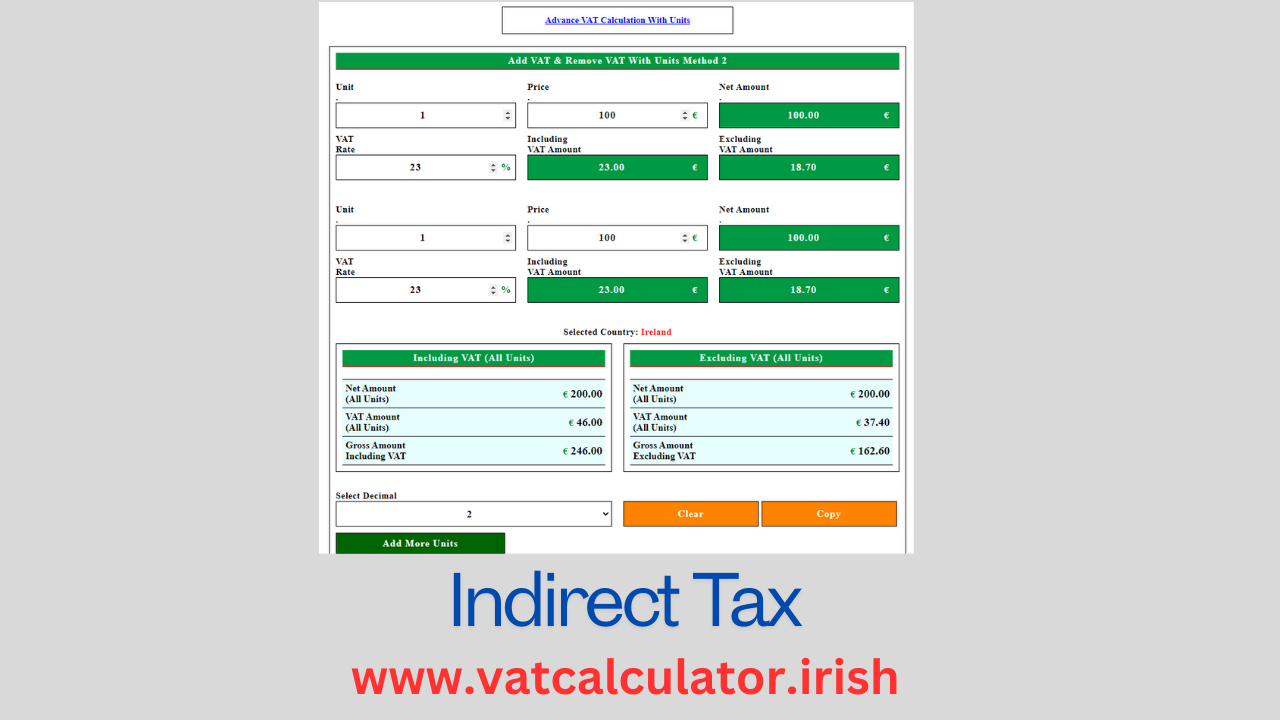

Value Added Tax (VAT)

Value Added Tax currently stands at 23% in Ireland, although reduced rates are applied to specific goods and services; 13.5% for services provided in the hospitality sector, with tourism-related services attracting a 9% rate. These rates are intended to provide a stimulus for economic activity in strategic sectors of the economy while providing government revenue.

Value-added tax in Ireland is directed by the provisions provided by the European Union and thereby is bound to head the directions of the EU law. All the businesses that are registered under the ambit of VAT are required to file periodical returns elucidating all their sales and purchases with detailed particularity with a view to having a transparent and responsible tax system.

Excise Duties and Other Taxes

Ireland also levies excise duties in addition to the value-added tax on particular commodities like alcohol, tobacco, and fuel. These taxes are meant to bring in revenue but also to influence behavior and make people healthy. The excise duties on tobacco products are higher to reduce the smoking habits among the citizens.

Other relevant examples could include customs duties in Ireland, considering its trade, not only with other members of the EU but also with the rest of the world. The customs framework also offers a way for the Irish government to control imports and protect the industries in Ireland in line with the EU's various trade agreements.

Conclusion

Indirect tax has a strategic role in the fiscal landscape of any given country because it influences consumer behavior, increases government revenue, and affects economic policy. It has the benefits of a broad base and, with a few exceptions, is fairly easy to comply with. However, many challenges are still ahead, most of them concerning issues of equity and administration.

These balance, within VAT and excise duties, the indirect tax system in Ireland to ensure revenue is generated in a way that does not hurt economic growth or public welfare. The Irish government, within this dynamically changing economy, is seen revising its indirect tax policies to make them effective, efficient, and fair enough to support enterprises and citizens alike.